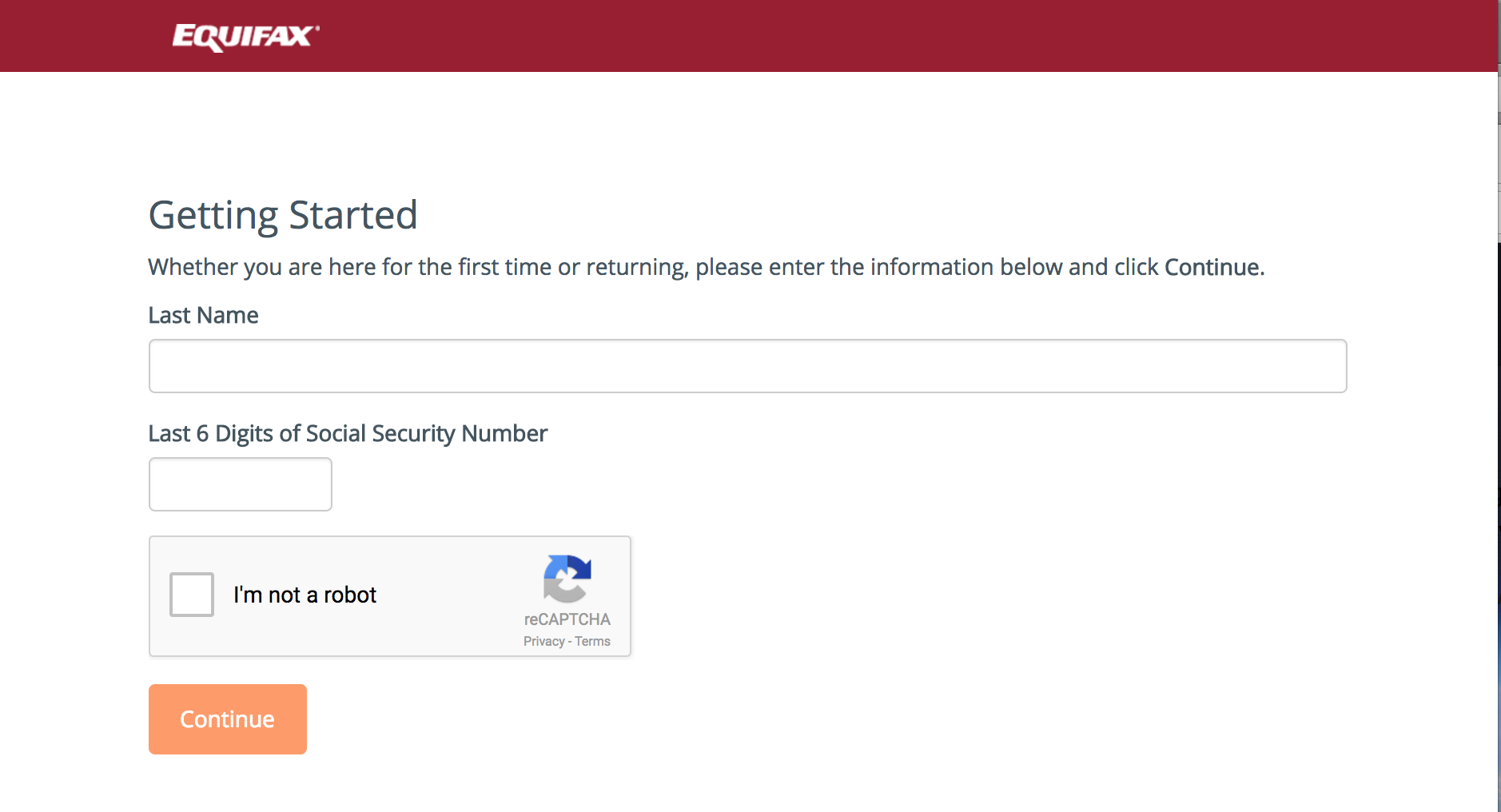

To make your request, you’ll need to include personal information, including your: You can typically request a credit freeze online, by phone, or by mail. To place a credit freeze, you need to contact each of the three major credit bureaus separately - Experian, Equifax, and TransUnion.Ĭredit locks are free, but can take anywhere from a few hours to several business days to be put in place. 💡 Related: Should I Freeze My Credit? → How Do I Request a Credit Freeze? With a credit freeze in place, even credit card companies wouldn’t be able to issue you a new credit card.Ī security freeze lasts indefinitely, or until you "thaw" your account. This means that scammers won’t be able to open new accounts in your name. But when your credit file is “frozen,” it can’t be accessed by anyone - even you. When you apply for a loan or line of credit, the lender checks with the credit reporting agencies to see if you qualify. a “Security Freeze”)?Ī security or credit freeze is a way to prevent the credit reporting bureaus from sharing your credit report to new lenders without your explicit consent. It’s a good idea to scan these for any unrecognized accounts or hard credit inquiries as well as incorrect information (such as your address or phone number).

EQUIFAX SECURITY FREEZE HELP FREE

Note: You’re entitled to a free credit report each year from all three credit bureaus at. You’re locked out of online accounts (i.e., your passwords stop working).Someone stole your tax return or used your identity to get government benefits.

A sudden change in your credit score (a credit monitoring service like Identity Guard will catch these changes early and alert you to any potential fraud).Getting calls from debt collectors about debts that you don’t recognize (or being denied for loans).Seeing unrecognized hard inquiries or accounts in your credit file.Learning that your personal information was leaked in a data breach.Finding unfamiliar charges on your bank or credit card statements.When Should I Consider Freezing or Locking My Credit?Ĭredit locks and freezes are best used if you think or know that your identity has been stolen.Ī few of the main warning signs of identity theft include: If fraudsters have access to your credit, bank account, or other financial information, you should consider fraud protection services such as credit monitoring. Note: Neither a credit lock or freeze can stop scammers from accessing your current accounts. Here are the ways that a credit lock and credit freeze differ:

If identity thieves try to open a new account or take out a loan in your name, a lock or freeze blocks their attempts because the lender won’t be able to pull your credit history. However, each one has a few unique differences that will influence whether or not it’s the right choice for you and your situation.īoth a credit lock and credit freeze effectively hide your credit history from lenders and creditors. Many people use the terms credit lock, credit freeze, security freeze, and fraud alert interchangeably.

EQUIFAX SECURITY FREEZE HELP HOW TO

freeze, the pros and cons of each, and how to choose the right one to protect your finances from fraudsters. In this guide, we’ll cover the basics of a credit lock vs. But there are a few key differences that can help you decide which one is right for you. Yet, despite these massive losses, few people do enough to proactively protect their finances and online accounts from fraudsters, thieves, and con artists.Ī credit freeze (also known as a security freeze) and a credit lock are two ways to help prevent criminals from using your stolen information for financial gain.īoth credit locks and freezes make it harder for scammers to open new accounts or take out loans in your name. What’s The Difference Between a Credit Lock and Freeze?ĭepending on which source you read, Americans were defrauded out of anywhere from $5.9 to $52 billion, last year alone.

0 kommentar(er)

0 kommentar(er)